Q1 PIMG Commentary: Economic Resilience Supports Another Good Quarter

The first quarter proved to be another constructive period for most equity markets. The positive momentum from late 2023 has continued thanks to decent corporate earnings, a resilient economy and inflationary readings that are trending closer to targets. The much anticipated and often quoted global recession has yet to materialize in the face of tighter monetary policy. Much of 2023’s equity market performance was carried by a select few mega cap companies that did extraordinarily well but over the last quarter we are seeing early signs that the breadth of this rally is in fact broadening out. While the balance of the year will likely be clouded by U.S. political rhetoric and ongoing global geopolitical tensions, our message will continue to be focused on the core metrics of our portfolios which are ultimately aligned with our clients longer term goals and objectives.

Equity and bond markets continued to take their cues from reported inflation. The excess inflation that plagued economies in 2022 seems to be behind us, however the economy’s underlying strength bolstered by a robust job force and strong consumption is preventing central banks from cutting interest rates at this time. Despite many headline layoff announcements, the labour market remains tight and job openings are still relatively plentiful. The economic slowdown that central bankers are doing their best to engineer is so far happening at a palatable pace. Perhaps the lagged effect of tighter monetary policy has yet to play out but given the litany of headwinds equity markets have faced over the past year (U.S. banking crisis, Ukraine, Israel, China slowdown), it may be that the economy can find a footing without falling into a more pronounced recession. So far, that soft-landing scenario looks to be the playbook that asset prices are reflecting.

While the first quarter was a good one for most sectors, the above-mentioned rigidity in interest rates continues to create a bifurcated market. Interest rate sensitive sectors such as telecommunications, real estate and utilities remain underperformers. Companies with higher leverage relative to their peers are seeing their stock prices lag as revenues are being spent servicing debt.

Conversely, companies who have managed balance sheets more effectively are less impaired by higher debt servicing levels allowing for more flexibility to pursue growth initiatives. Leverage can work in a company’s favour when rates are suppressed but quite the opposite in a more restrictive environment as many companies are learning over the course of this business cycle. The best opportunities will come from those businesses that are showing leadership through strong internal controls and prudent cash flow management.

One such company we bought for clients in the first quarter was Methanex. This Vancouver based company is one of the largest global producers of Methanol, a product derived from natural gas that is used to create the building blocks for things like paint, plywood, plastics, fleece, LCD screens, marine fuel and many other products we interact with daily. They have been investing heavily in future growth and this year will complete the third phase of their Geismar 3 plant in Louisiana. The total cost of this plant will come in a little over $1.3B which was funded through a combination of debt, equity and cash on hand. Because of the increase in debt that the company had accumulated their stock performance had been challenged over the past year or so. However, with costs now mostly behind them, the future production and associated cash flow should allow them to aggressively de-lever and focus on shareholder friendly initiatives like dividend increases and stock buybacks. This should prove to be a good example of how debt can be used for the benefit of equity holders.

As a result of strong performance throughout the quarter, we were net sellers across most of our models. We harvested some profits amongst a few positions that had reached elevated valuations and had become overbought based on our technical work. We also decided to sell our holding in Boeing as we believe their recent issues and questions around reliability will likely lead to higher costs and reduced orders for next generation aircraft. Open Text was another name we decided to sell as a lack of execution on recent acquisitions and persistent underperformance has us believe money is better off elsewhere. Exiting the month of March cash levels were around five percent which will be used to fund new opportunities as they present themselves.

A major theme of last year had been the narrow performance of U.S. equity markets. The Magnificent 7, which is made up of Apple, Amazon, Nvidia, Alphabet, Meta, Microsoft and Tesla, accounted for two thirds of the S&P 500 market performance in 2023. Fortunately, many of these names are long standing positions in client portfolios which has contributed greatly to overall returns. However, the lackluster performance for many other areas of the market had been less inspiring. We do expect this year could play out differently as investors look for value outside of these names and sector leadership transitions to other areas of broader markets. Early in 2024 we are seeing evidence of this with energy, commodities, industrials, and financials displaying solid relative performance. In the end, a broadening of market participation would be a healthy and welcome development and supportive of returns as portfolios are positioned in many of these sectors.

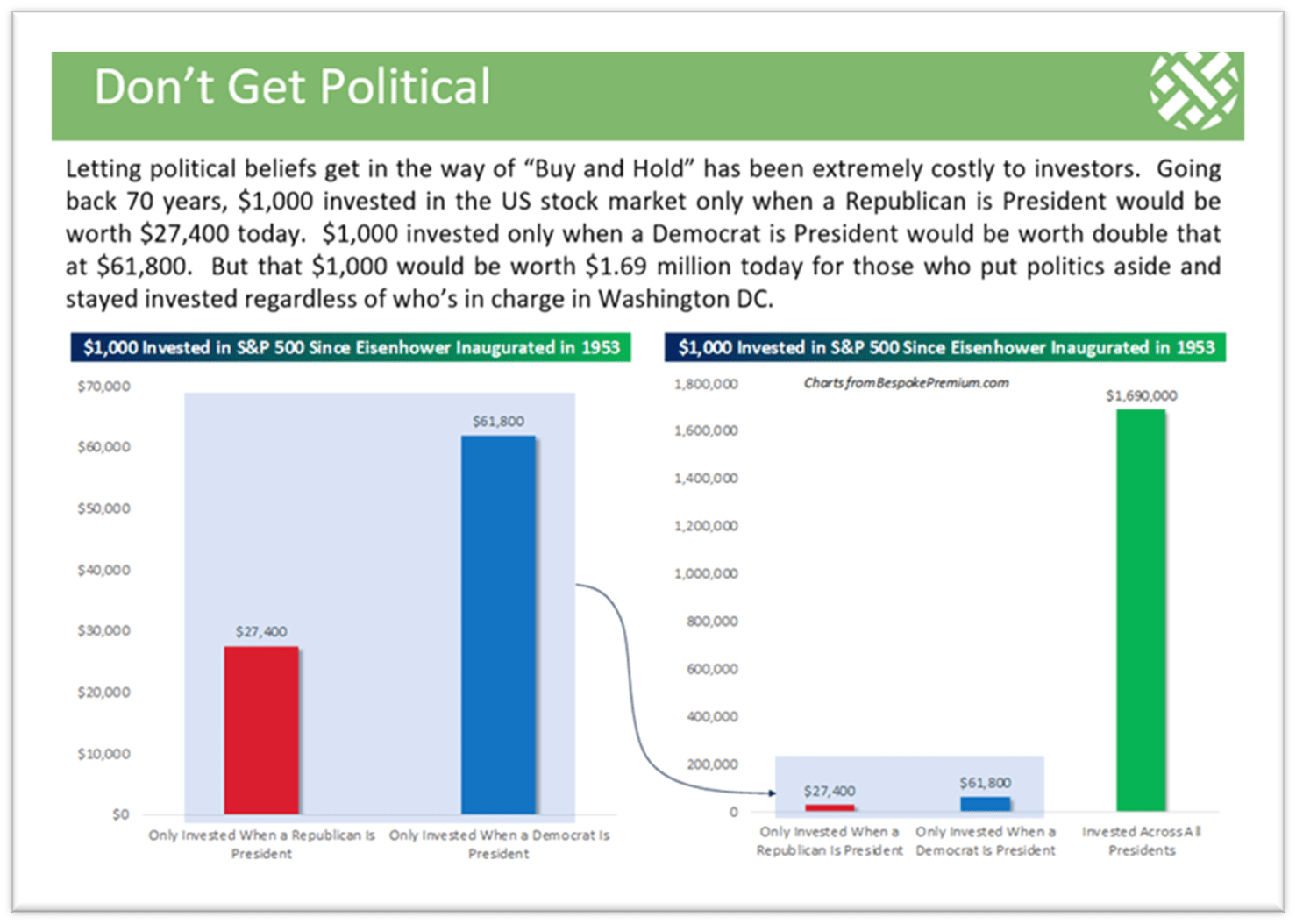

The coming U.S. election will no doubt provide some fireworks and associated volatility. We remain agnostic as to who wins the coming election when it comes to the impact on markets. History shows that U.S. markets have performed better under Democratic control with an average annual return of 14.50% compared to Republicans with a 10.7% return (Source: Clearnomics S&P 500 returns since 1933). We also take comfort knowing the current incumbents will be doing everything they can to grow the economy in the months ahead to improve their chances of re-election.

Hopefully the next few quarters prove uneventful. As noted, companies will be doing their best to navigate higher interest rates and the ones that are managing their balance sheets properly will be duly rewarded. Our time will be spent analyzing those businesses and looking for opportunities while always adhering to our deep-rooted portfolio process. We encourage clients to continue managing their own balance sheets and allow the benefits of asset ownership and proper diversification to do the rest. We have seen that adhering to the latter has only rewarded those looking to build wealth over the longer term.

Source *LPL Financial

Your Plena Wealth Advisory Team

This newsletter has been prepared by Plena Wealth Advisors. Statistics and factual data and other information in this newsletter are from sources Raymond James

(RJL) believes to be reliable but their accuracy cannot be guaranteed. This newsletter is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. RJL and its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. This newsletter is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. RJL is a member of the Canadian Investor Protection Fund.

Raymond James (USA) Ltd., member FINRA/SIPC. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered.